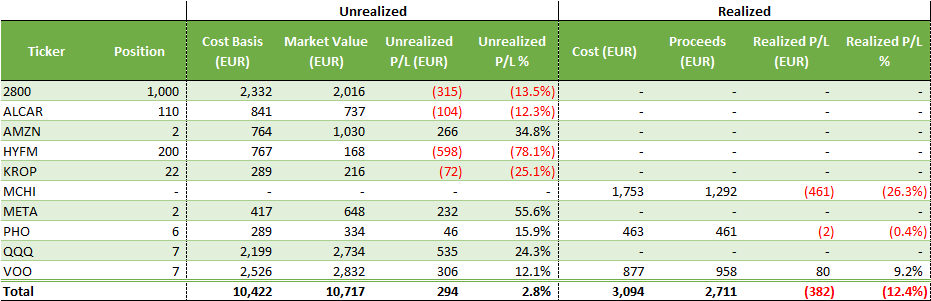

In Q4 2023, my long-term portfolio reached 10,717€ with an unrealized loss of -88€.

+21.1% vs. last quarter

+188.8% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 1.63 positions of QQQ @ USD 368.07 for a total of EUR 600 (fees included)

- Bought 1.50 positions of VOO @ EUR 399.98 for a total of EUR 600 (fees included)

As planned, I resumed my DCA investments on my US ETFs and took advantage of the recent bull market on the US market. It seems like the FED stopped increasing their interest rate but now, the main question right is to know when are they going to start decreasing them. Market insiders and institutions think that the rates will start decreasing as early as March 2024. I personality would take a more conservative approach but I do think the FED will pivot in the second half of 2024. I’m expecting tech stocks to decrease in value if the market does not see the interest rates decreasing in March. It will then be time to buy tech stocks. In any cases, I will invest more heavily on tech stock in Q1 2024.

China market is in a very dangerous situation. I stopped all my DCA investments on my Chinese market ETF (2800 Hong Kong listed) a few months ago. The Chinese market is currently on a 10-year low and I do not know when it is going to stop. I am still on standby, waiting for any good news regarding the Chinese economy.

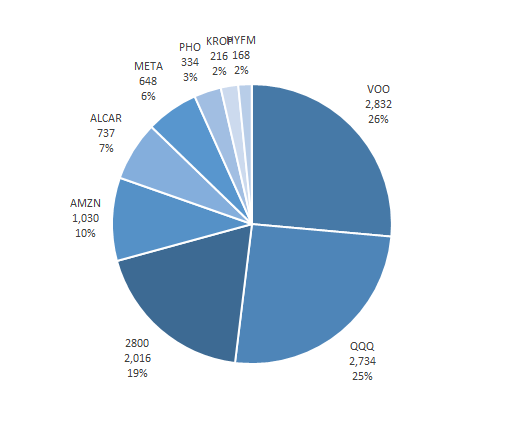

Allocation

As of Q4 2023, my strategy is still having a 75%/25% long-term portfolio.

- Market index ETFs represent 70% of my portfolio (QQQ, VOO and 2800).

- Thematic ETFs represent 5% of my portfolio (KROP and PHO).

- Individual companies represent 25% of my portfolio (AMZN, META, ALCAR HYFM).

I am planning to invest more into large tech companies in Q1 2024. I will need to invest into QQQ or VOO accordingly to keep this 75%/25% split.

Performance

Top performer of the quarter:

- ALCAR +39.9% in Q4 vs Q3

- AMZN +17.4% in Q4 vs Q3

- META +15.4% in Q4 vs Q3

- QQQ +13.9% in Q4 vs Q3

- VOO +11.2% in Q4 vs Q3

All tech companies have increased in value based on the disinflation and the rumors that the FED will start decreasing their interest rates as early as March 2024. We can note that the NASDAQ (i.e. QQQ) grew faster than the S&P500 (i.e. VOO) on these news.

Worst performer of the quarter:

- HYFM -21.5% in Q4 vs. Q3

The company seem to struggle with sales growth and margin. I’ll hold my position since it represents only 2% of my total portfolio.

2 thoughts on “Long-term portfolio – Q4 2023”