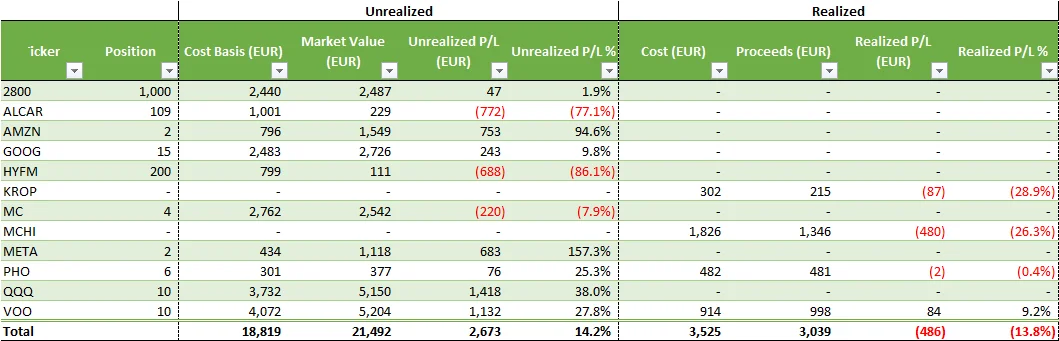

In Q4 2024, my long-term portfolio reached 21,492€ with an unrealized gain of +2,673€.

+21.1% vs. last quarter

+100.5% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 0.91 positions of QQQ @ USD 494.56 for a total of USD 453.22 (fees included)

- Bought 0.84 positions of VOO @ USD 533.50 for a total of USD 453.19 (fees included)

- Bought 10 positions of GOOG @ USD 170.61 for a total of USD 1,707.19 (fees included)

The market reached new all-time high in Q4 2024 and I am still investing around USD 1,000 every quarter with my DCA strategy. As the FED is holding its interest rates, I was expecting the tech companies to decrease in value… and I was wrong. I did not anticipate the impact of the US elections and having Trump as the new President. Trump has strong relationships with the CEOs of the Magnificent 7, especially with Elon Musk, which set the market on fire.

Luckily, I reinforced my investment on Alphabet (GOOG) with an additional 10 shares just before the tech boom. Since I have first invested in the company in Q2 2024, the share price stayed stable until the elections. I actually bought these shares for cheaper than the first ones. Alphabet’s financials are strong and their advertising business is still growing double digit every quarter. If the company succeeds in the AI and the self driving car battles, the company will still grow exponentially.

The Chinese market is still challenging. As mentioned in my previous update on my long-term portfolio, the luxury industry is significantly impacted by the Chinese downturn. I took this opportunity to invest EUR 2,700 in LVMH. As of the end of Dec 2024, I lost a couple of hundreds euros on this investment but I believe that this was a great long-term investment. Stay tuned for a full analysis of LVMH!

Allocation

With the addition of Google to my portfolio, my 75%/25% strategy is unbalanced.

- Market index ETFs represent 60% of my portfolio (QQQ, VOO and 2800).

- Thematic ETFs represent 2% of my portfolio (KROP and PHO).

- Individual companies represent 38% of my portfolio (AMZN, GOOG, META, ALCAR HYFM).

I will need to re-balance my portfolio in the next quarter to stick with my initial strategy.

Performance

Top performer of the quarter:

- AMZN +18.5% in Q4 vs. Q3

- GOOG +13.1% in Q4 vs. Q3

- QQQ +6.2% in Q4 vs. Q3

All tech companies have increased in value with the election of Trump as the new US President. On the other hand, the S&P500 increased but stayed more flat than the NASDAQ.

Worst performer of the quarter:

- ALCAR -16.8% in Q4 vs. Q3

- PHO -6.0% in Q4 vs. Q3

Carmat (i.e. ALCAR) announced a new capital raise in Q4 with dilution of the current shareholders. The commercialization of their artificial heart is still on good tracks but I will not invest further in the company as long as its cashflows cannot sustain its business.