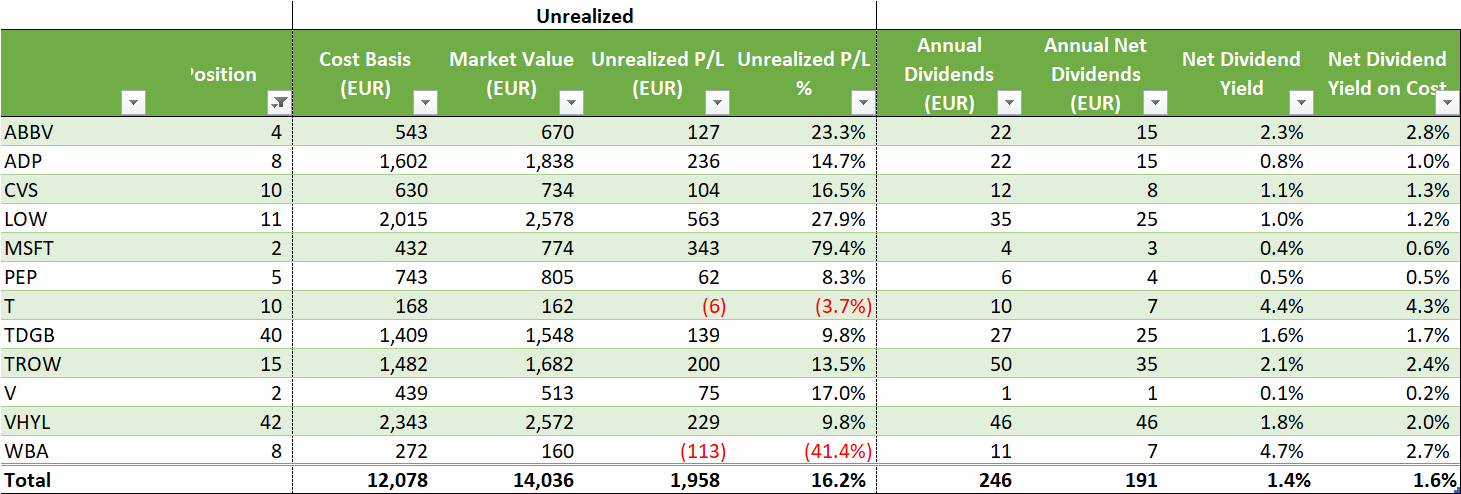

In Q1 2024, my dividends portfolio increased to 14,036€ and returned 53€ of net dividends for the quarter.

Passive income: 53€

-13.1% vs. last quarter

+253% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 7 shares of VHYL @ EUR 61.25 for a total of EUR 432 (fees included)

- Bought 5 shares of TDGB @ GBP 33.06 for a total of GBP 169 (fees included)

This quarter has been quiet in terms of investments. My new contributions are dividend-focused ETF that are part of my DCA strategy.

With the market reaching its all-time high, I may have been more careful with my investments and try to not purchase overvalued stocks. I’ve been probably too careful since I did not make any new contributions to my portfolio beyond my DCA. It is a mistake and these articles actually help me realizing these mistakes.

Next quarter, I need to spend some time reviewing a few companies that I have in my portfolio and maybe explore a few new ones to add into my dividends portfolio. I have to focus more on the quality of a stock more than its price. Actually, price does not really matter for long-term investment. If you pick a solid company, its stock price will definitely increase 10 or 20 years from now. I should keep investing in quality businesses regardless of the stock price.

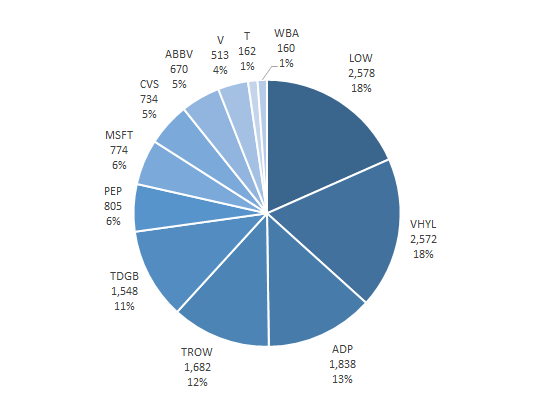

Allocation

Allocation target: 30% ETF and 70% individual stock.

- Dividends ETFs represent 29% of my portfolio (VHYL and TDGB).

- Individual companies represent 71% of my portfolio.

Last quarter, I wanted to rebalance my portfolio to get closer to my 30% / 70% target. Well, this is now done. My passivity allowed me to achieve it and I must now proceed with further investment while considering this balance.

My DCA on dividend-focused ETF is set at EUR 450 which means that my investment in individual stocks must be EUR 1,050 to keep my allocation target at 30% / 70%.

Performance

Top performer of the quarter:

- MSFT +16.86% in Q4 vs Q3

- CVS +13.30% in Q4 vs Q3

- T +14.38% in Q4 vs Q3

- LOW +8.17% in Q4 vs Q3

- V +12.57% in Q4 vs Q3

- WBA +16.46% in Q4 vs Q3

There is no much bad performing stocks for this quarter. The US market increased and my holdings have beneficiated from it. Microsoft is still on fire and I am very happy with CVS and Visa performances. I’m quite surprises with AT&T. I did not expect such a performance and I will need to look into it. I had mixed feelings about AT&T because of the Capex its operations required so it may be good time to do an arbitrage… to consider in Q2 2024.

I’m also quite disappointed with the ETF performances. Individual stocks are obviously more reactive to market movements. It will be surely the same during market downturns so it is always a good idea to keep a good chunk of my portfolio invested in ETF.