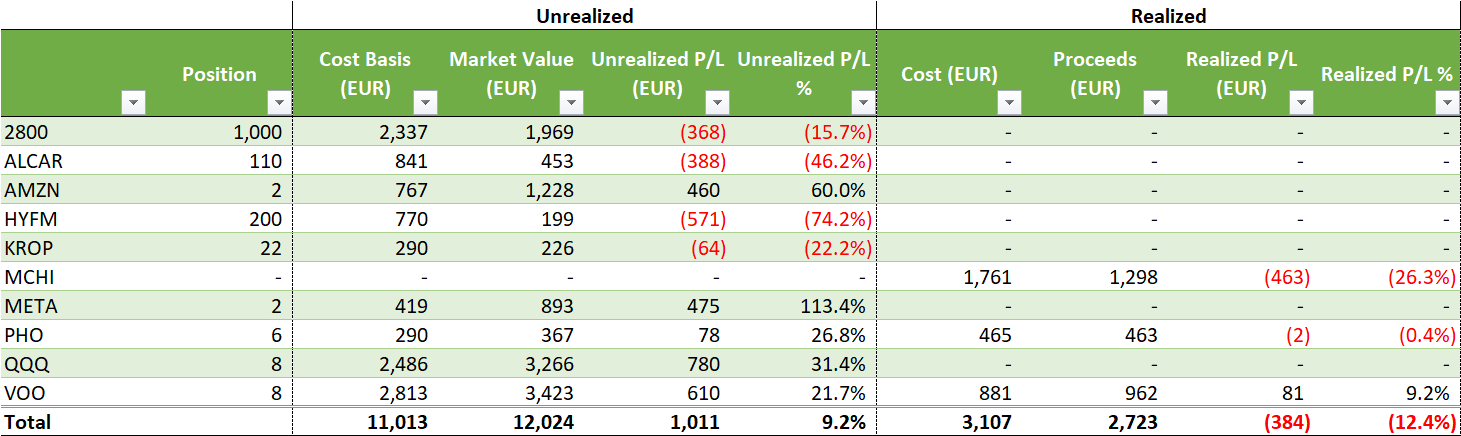

In Q1 2024, my long-term portfolio reached 12,024€ with an unrealized gain of +1,011€.

+12.2% vs. last quarter

+236.7% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 0.48 positions of QQQ @ USD 415.31 for a total of USD 201 (fees included)

- Bought 0.45 positions of VOO @ USD 443.32 for a total of USD 201 (fees included)

I am persisting with my DCA investments on my US ETFs but I am not investing heavily at the moment. As I expected in my article from last quarter, the FED did not decrease its interest rates in March 2024 and will most likely not do it before Q4 2024. However, the stock market has not decrease with this change in timeline… my anticipations were not correct on this point and not investing was probably a mistake. I am now wondering whether resuming investing significantly and keep building cash to wait for a better entry point. Let me know what should I do in the comment section below.

I personally think that there is a probability that the FED will turn dovish in December 2024 but I would not expect any movements before that date. The market seems to have integrated this new timeline in the prices but the market looks stronger than I expected. I will keep watching the US indexes and take a decision in Q2.

China market did not performed well in Q1 2024 but no major bankruptcies happened. It seems that the real estate market has stabilized and that China avoided a major crisis. This led to a regain in investors’ confidence which would explain the bounce-back of the HSI. However, consumption and employment rate are still low in China. Good news start coming to us but I still need to see stability and recovery before resuming my DCA into the Chinese market. I still very exposed (maybe too exposed) to the Chinese market with 16% of my long-term portfolio invested into a HSI index tracker.

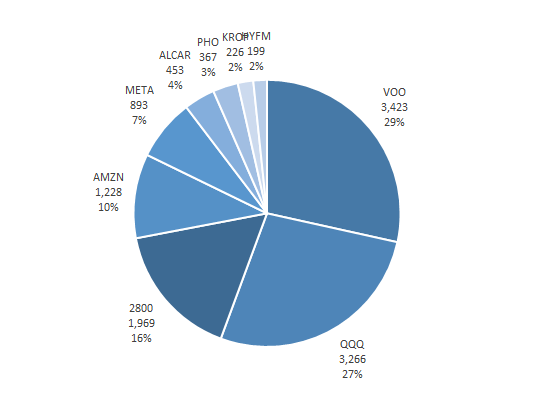

Allocation

As of Q1 2024, I am still targeting an allocation of 75% ETF & 25% individual stocks as a long-term portfolio strategy.

- Market index ETFs represent 72% of my portfolio (QQQ, VOO and 2800).

- Thematic ETFs represent 5% of my portfolio (KROP and PHO).

- Individual companies represent 23% of my portfolio (AMZN, META, ALCAR HYFM).

As I did not invest in individual stocks during Q1 2024, the proportion of ETF is now higher than the target. I would most likely try to find another blue chip stock to add to my portfolio (yes… I missed the Nvidia train).

Performance

Top performer of the quarter:

- META +37.2% in Q1 vs Q4

- AMZN +18.7% in Q1 vs Q4

- HYFM +17.6% in Q1 vs Q4

- VOO +10.1% in Q1 vs Q4

As the FED is not looking as dovish as expected, The S&P500 performed better than the Nasdaq in Q1 2024. My VOO position is among the top performer with a +10.1% QoQ while QQQ is “just” achieving around 8%. Most of the tech companies fell in price during the quarter except for the large tech companies known as “The Magnificent 7”. They took advantage of the AI trend and grew massively during the quarter. Meta, Amazon and Microsoft are a few examples in my portfolio(s) but you can also look up for Nvidia and you will quickly realize how these 7 stocks maintained the Nasdaq up there.

Worst performer of the quarter:

- ALCAR -39.7% in Q1 vs. Q4

Carmat SA (ALCAR) has decreased in price significantly following a dilution of its investors with the issuance of new shares. I am still bullish on the company as their testing and commercial rollup is doing great. The company stills need more cash to be sustainable but they have a great product and a promising market. I will most likely add up to this positions if the management confirmed that they will be no further dilution.