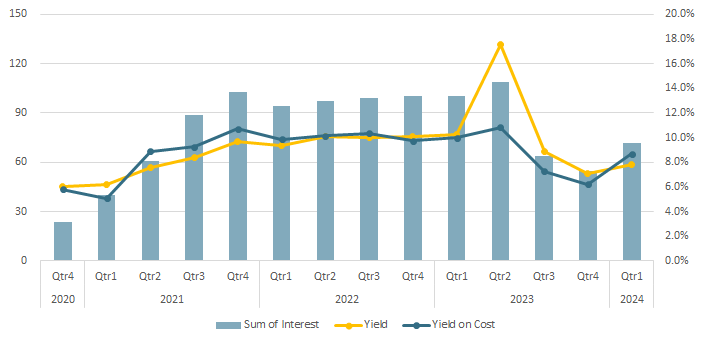

In Q1 2024, my crowdfunding portfolio increased to 3,932€ and returned 72€ for a yield-on-cost of 8.7%. The amount invested increased thanks to reinvestments but no additional funding was done during this quarter. My yield-on-cost also increased from 6.2% to 8.7% thanks to these reinvestments and because I withdrew 200€ from October.

Passive income: 72€

+17€ (i.e. +30.9%) vs. last quarter

-28€ (i.e. -28%) vs. the prior year period.

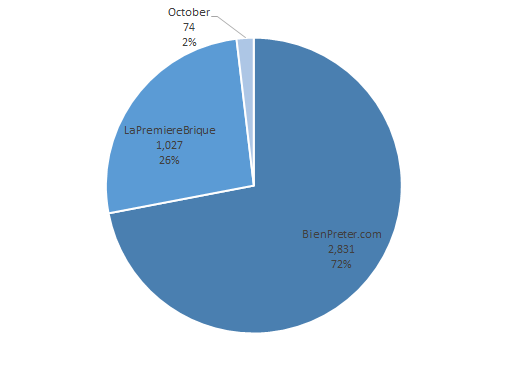

Allocation

One of the project in October website ended in January 2024 so I am just left with 2 projects on this website. Both project are supposed to end before the end of the year.

My position in LaPremiereBrique is stable. I received anticipated payments in 5 projects during Q1 which allowed me to reinvest in 3 new projects (cf. “Major update” section below). The platform is doing a great job of keeping investors informed about our projects. I received some good updates on several projects but also a couple of emails regarding delays of payments for 2 projects due in April 2024.

I am still in search for a new crowdfunding website. While searching, I actually found an interesting project on Tantiem which is a tokenized real estate investment platform such as RealT. Stay tuned for news on this new investment journey.

Goals:

- Diversify my platform exposure. (target 2024)

- Exit from October.

- Hold my position on LaPremiereBrique for the moment.

Major Updates

In Q1 2024, I received 72€ of my invested capital back from LaPremiereBrique. I used this money to reinvest into 3 new projects for a total of 150€.

As for BienPreter, I invested a total of 690€ into 16 different projects. The majority of this new investments came from the cash that was sitting on my BienPreter account but also form the 317€ interests and capital I received from the website during this quarter.

As of March 2024, I still have 4 projects in default for a total of 208€:

| Platform | Project | Provisions | Comments |

| October | FMPA | 115€ | Company placed in liquidation |

| October | Interlink Transport | 19€ | Certificate of uncollectible funds received |

| October | LOC MAT 43 | 7€ | Company placed in liquidation |

| October | Villari | 67€ | Company placed in liquidation |

None of these investment will be paid back to me.

Passive Income Evolution

We finally returned to growth in Q1 2024. The cash that was sitting in my different accounts was either reinvested or withdrawn (for October) which help me improve my yield-on-cost. It increased to 8.7% which seems pretty good considering that the vast majority of my projects on LaPremiereBrique are still ongoing. As a reminder, my passive income dropped in Q3 2023 because I was building my project portfolio in LaPremiereBrique which does not pay interest on a monthly basis but when projects are completed. I am expecting to see further increase in my interest income as the first wave of my LaPremiereBrique projects will come to an end later in 2024.

All my cash is almost fully reinvested and I may now consider allocating more funds to my crowdfunding portfolio. My crowdfunding portfolio represents only 4% of my total assets which is very limited. I may increase my exposure later this year.