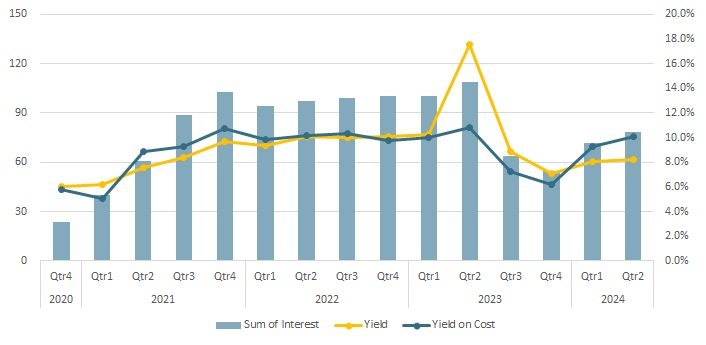

In Q2 2024, my crowdfunding portfolio increased to 3,818€ and returned 78€ for a yield-on-cost of 10.1%. The return on my investments keeps increasing as my position in LaPremiereBrique is maturing. I start to receive and reinvest the interests from my initial investments on the platform making it a stable revenue stream. I’m expecting the yield-on-cost to stabilized in the future.

Passive income: 78€

+6€ (i.e. +8.3%) vs. last quarter

-31€ (i.e. -28.4%) vs. the prior year period.

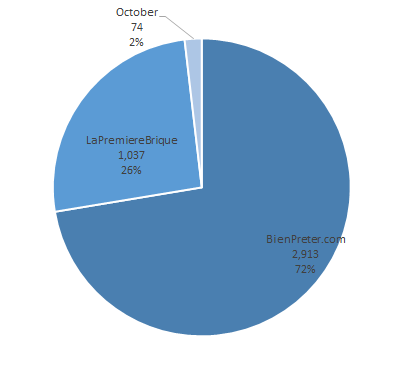

Allocation

It is official, the BCE has finally decreased its interest rates. This is a great news for the real estate industry for the coming months and years but in the meantime the industry is still struggling. I have more and more delays in my investments in LaPremiereBrique.

A total of 4 projects have been delayed on LaPremiereBrique. Three of them were supposed to end in April 2024 and the other one in June 2024. I already received some partial repayment for the majority of them and I am confident in getting my capital back.

BienPreter is still running smoothly. I start to see a snowball effect with an increase of almost 100€ in my invested capital thanks to the reinvestment of my interests only. There is no delay to highlight. I am very happy with the platform and will keep reinvesting my proceeds overtime.

I’m still pursuing my exit from October. I have 2 projects active on the platform and their last installment is scheduled for September 2024.

Goals:

- Diversify my platform exposure adding Clubfunding and/or Baltis (target 2024).

- Exit from October.

- Increase my position on LaPremiereBrique in 2025.

Passive Income Evolution

In Q2 2024 my yield-on-cost increased to 10.1% vs. 8.7% last quarter. It is great to see that my ROI in the 10% range. This increase is mainly due to two factors:

My first projects in LaPremiereBrique are coming to maturity which generates significant returns as the interest income is paid at the end of each project on this platform. I should see more stability in my crowdfunding performance from now on.

I also improved my reinvestment discipline. Too much cash was just seating on my different platforms waiting to be reinvested. This dormant cash was a burden and impacted my yield significantly.

Major Updates

As of June 2024, I lost a total of 211€ on 4 projects from October investment platform. All companies were placed in liquidation and my money will most likely not be returned to me.

| Platform | Project | Provisions | Comments |

| October | FMPA | 115€ | Company placed in liquidation |

| October | Interlink Transport | 19€ | Company placed in liquidation |

| October | LOC MAT 43 | 10€ | Company placed in liquidation |

| October | Villari | 67€ | Company placed in liquidation |

I also have delayed projects on LaPremiereBrique for a total of 59€. All these projects have already been partially paid back and guaranteed by a first-rank mortgage. I am thus quite confident that I will get some if not all my money back in this case.

| Platform | Project | Provisions | Comments |

| LaPremiereBrique | Le Chêne | 16€ | Company placed in liquidation |

| LaPremiereBrique | Le Vallon | 17€ | Company placed in liquidation |

| LaPremiereBrique | Le Cube | 7€ | Company placed in liquidation |

| LaPremiereBrique | Villari | 19€ | Company placed in liquidation |

This a good opportunity for me to highlight how important is the project guarantee when you invest in crowdfunding. In the case of October, I had absolutely no guarantee whatsoever with the company I invested it. I just relied on the performance of the company and on the good faith of its top management.

But I learnt from my mistakes and became more and more selective in my investments. I especially like the real estate projects because they often come with a mortgage guarantee. I NEVER invest in a real estate project without this type of guarantee. This is also one of the reasons why I withdrew some money from BienPreter to reallocate it to LaPremiereBrique. Although none of my projects defaulted on BienPreter, I technically do not have much guarantee on my projects… Let me know if you would like me to deep dive into the different existing guarantees you can have in crowdfunding projects.