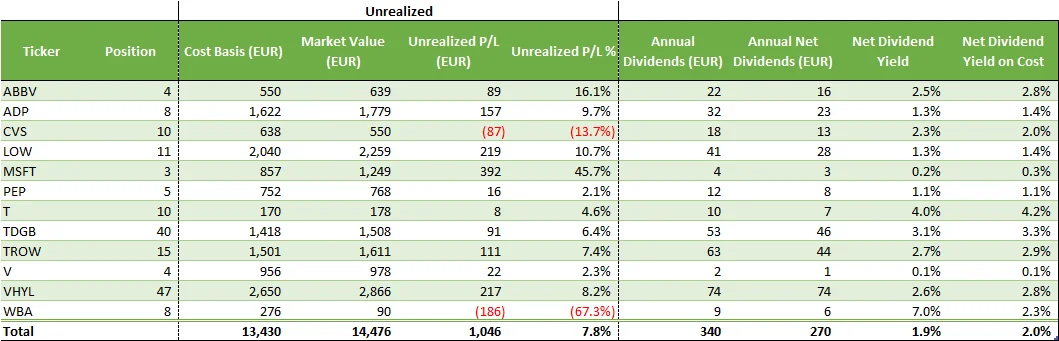

In Q2 2024, my dividends portfolio increased to 14,476€ and returned 109€ of net dividends for the quarter.

Passive income: 109€

+106% vs. last quarter

+252% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 4.9 shares of VHYL @ EUR 61.15 for a total of EUR 306.53 (fees included)

- Bought 2 shares of V @ USD 274.23 for a total of USD 549.55 (fees included)

- Bought 1 share of MSFT @ USD 450.14 for a total of USD 451.23 (fees included)

I increased my position in two companies I consider high quality companies: Visa and Microsoft. They actually have similar characteristics. They both show high growth in revenue and free cash flow and keep their debt under control. They also have a very low starting dividend yield but have increased their dividends significantly overtime. They are definitely in the “low yield, high growth” category.

Since I have a long investment horizon, I am comfortable with a lower yield if it comes with substantial growth potential.

I also keep investing in my Vanguard dividend ETF (VHYL) as part of my DCA strategy. I am considering increasing my DCA contribution in VHYL in the future.

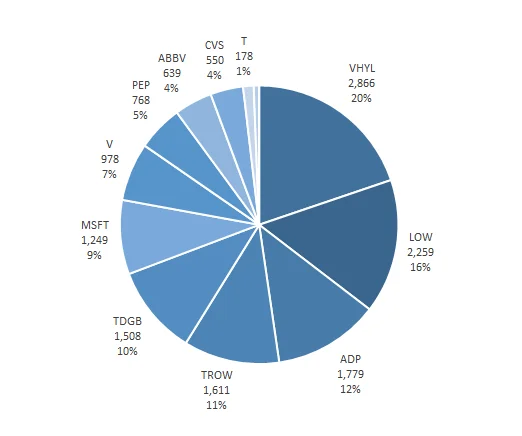

Allocation

Allocation target: 30% ETF and 70% individual stock.

- Dividends ETFs represent 30% of my portfolio (VHYL and TDGB).

- Individual companies represent 70% of my portfolio.

Last time, we calculated that maintaining a 30%/70% allocation while investing EUR 450 in ETFs each quarter will lead to a contribution of approximately EUR 1,050 in individual stocks. This quarter, my total investments in Visa and Microsoft amounted to EUR 1,000, enabling me to maintain a solid allocation.

My positions in Visa and Microsoft now reach 7% and 9% of my total portfolio respectively. I may decide to increase my exposure to these companies and make them part of the cornerstones of my portfolio just like LOW and ADP. I am actually a bit concerned that I am more exposed to T.Rowe than Visa and Microsoft… This have to change in 2024.

Performance

Top performer of the quarter:

- T +9.2% in Q2 vs Q1

- MSFT +5.3% in Q2 vs. Q1

Worst performer of the quarter:

- WBA -38.1% in Q2 vs. Q1

- CVS -25.8% in Q2 vs. Q1

- LOW -11.6% in Q2 vs. Q1

The market was quite slow this quarter. The S&P500 was down 4% in April and then recovered and went up 9% between May and June. Unfortunately, my portfolio did not perform as good as the market. Almost all my stock decreased in value over the quarter.

We suffered a massive correction on the drugstore retailers CVS and WBA with -25.8% and -38.1% respectively during the quarter. They both have stable revenue growth but struggle with profitability. WBA seems to be a dead cause… They already cut their dividends by half at the beginning of the year as their cash flows plunged in 2023. 2024 does not seem to be any better for the company. I have a bit more hope regarding CVS as they managed to keep their operating cashflows at a decent level. However, I would need to have a closer look at their earnings report to avoid doing the same mistake as WBA. It may be better to close my position before it is too late…