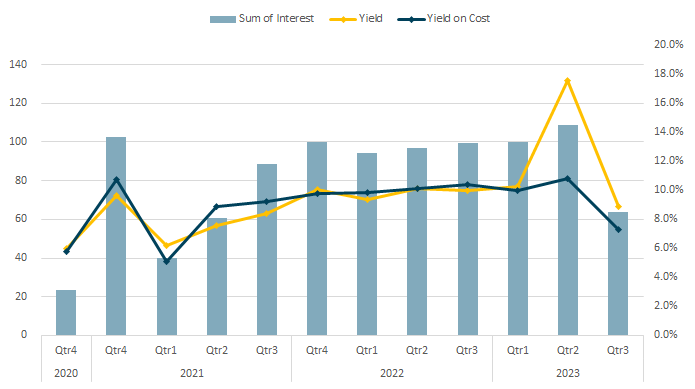

In Q3 2023, my crowdfunding portfolio decreased to 2,705€ and returned 64€ for a yield-on-cost of 7.3%. The overall decrease in performance of this portfolio in mainly due to the low activity with limited reinvestments.

Passive income: 64€

-45€ (i.e. -41.3%) vs. last quarter

-35€ (i.e. -35.4%) vs. the prior year period.

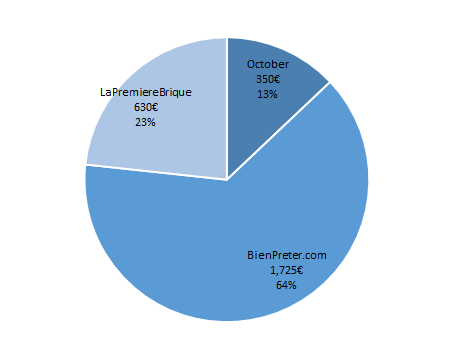

Allocation

With the current interest rates and all the rumors regarding the future of the economy and more specifically regarding the real estate industry, I decided to slow down my investments into my crowdfunding portfolio.

As a result, my overall investment decreased versus Q2. I reinvested money in a few projects on LaPremiereBrique and on BienPreter but I was more selective than usual.

I’m still pursuing my exit from October so there will be no additional investment for this platform. I just have 3 ongoing projects left on this platform and a few other projects in default that I will talk about in the next section.

Goals:

- Diversify my platform exposure adding Clubfunding and/or Baltis (target 2024).

- Exit from October.

- Increase my position on LaPremiereBrique.

Passive Income Evolution

In Q3 2023 my yield-on-cost decreased to 7.3% due to the small amount of reinvestment made during the quarter. My cash position increased and is just waiting to be reinvested when I will judge it will be a good time to reallocate money into the crowdfunding.

Seeing a decrease in interests received is concerning to me and highlight the lack of activity in this portfolio. This is defining I need to change for next quarter.

Major Updates

As of September 2023, I still have 4 projects in default for a total of 211€:

| Platform | Project | Provisions | Comments |

| October | FMPA | 115€ | Company placed in liquidation |

| October | Interlink Transport | 19€ | Company placed in liquidation |

| October | LOC MAT 43 | 10€ | Payments rescheduled but defaulted again. |

| October | Villari | 67€ | Payments paused for more than 120 days. Court hearing scheduled on the 16th of November. |

I have little hope that I will get my money back on any of these loans. October is the only platform for which I had issues and this is why I will redirect my money to other platforms going forward.