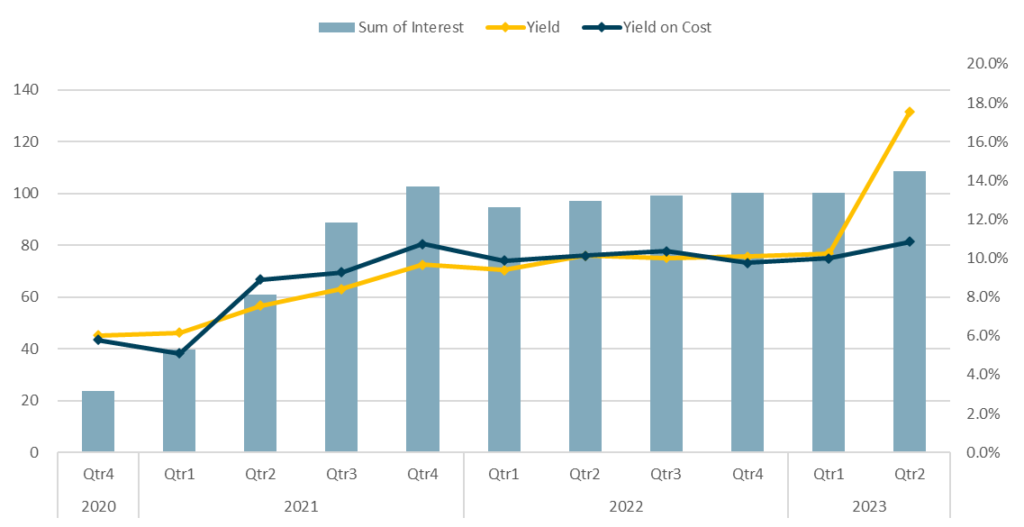

In Q2 2023, my crowdfunding portfolio reached 3,905€ and returned 109€ for a yield-on-cost of 10.8%.

-

- +9€ (i.e. +9.0%) vs. last quarter

- +12€ (i.e. +12.4%) vs. prior year period

Passive Income Evolution

The yield spiked in Q2 2023 because I received the reimbursement of a few projects but I did not immediately reinvest the money received. Thus, my capital invested decreased significantly, leading to a higher yield than usual. This is one of the reason why I prefer to look at my yield-on-cost which is my yield on the cash I injected into these platforms.

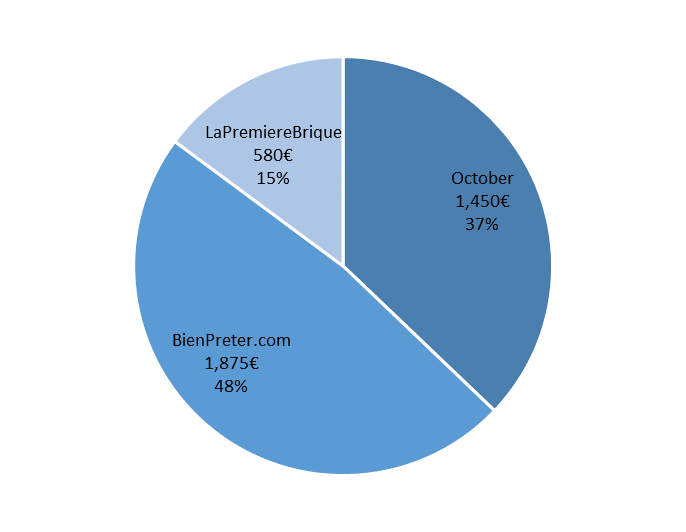

Allocation

As you can see, my portfolio heavily relies on two platforms: BienPreter and October. This is something I definitely want to change.

In the short term, I want to exit from October. My experience with this platform was not the best and I would not recommend anyone to go for it. Yields are not enticing and I had a lot of defaults.

I also want to increase my position on LaPremièreBrique significantly. This is a platform I discovered recently and which has a lot of good reviews from investors. They mainly focus on property flipping and offer strong guarantees such as first mortgages.

In the long run, I would like to try new platforms such as Clubfunding and Baltis but it would require additional funding since the minimum ticket on these platforms is 1,000€.

Major Updates

As of June 2023, I have 4 projects in default for a total of 211€:

| Platform | Project | Provisions | Comments |

| October | FMPA | 115€ | Company placed in liquidation |

| October | Interlink Transport | 19€ | Company placed in liquidation |

| October | LOC MAT 43 | 10€ | Payments rescheduled |

| October | Villari | 67€ | Payments paused for more than 120 days |

I have little hope that I will get my money back on any of these loans. October is the only platform for which I had issues and this is why I will redirect my money to other platforms going forward.