Lowe’s Companies, Inc. is a home improvement company. The Company offers a complete line of products for construction, maintenance, repair, remodeling, and decorating. It is focused on offering a wide selection of national brand-name merchandise complemented by its selection of private brands. Its services include installed sales and Lowe’s Protection Plans and Repair Services. The Company offers installation services through independent contractors in many of its product categories. It offers extended protection plans for certain products.

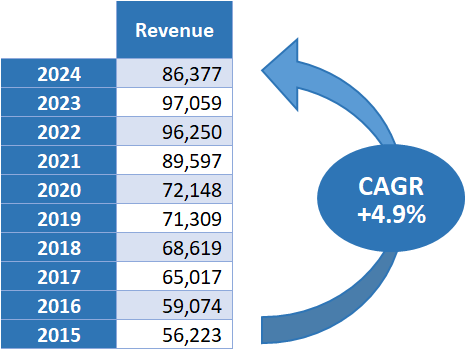

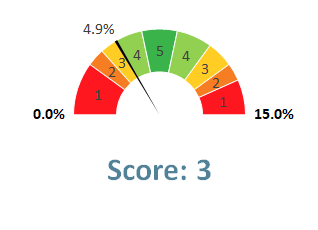

Revenue Growth

For the first time in the last decade, Lowe’s turnover decreased year-on-year. The company demonstrated steady revenue growth overall with a Compound Annual Growth Rate (CAGR) of 6.9% but the sales fell to USD 86 billions in 2024.

According to the company, the sales decrease is partially due to the sale of their Canadian retail business back in 2022. However, the sales still decreased by approximately 5% on a like-for-like basis which is concerning but could be explained by the high inflationary environment we experienced in 2023 and early 2024. Lowe’s sales must bounce back next year to still be considered as a high quality stock.

Find out more about the scaling system.

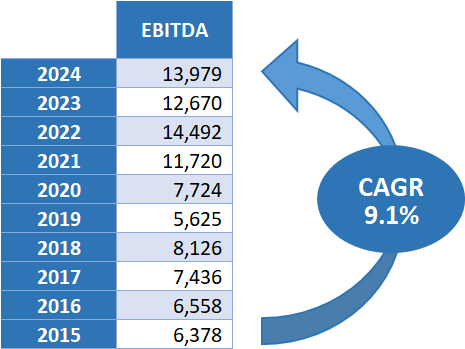

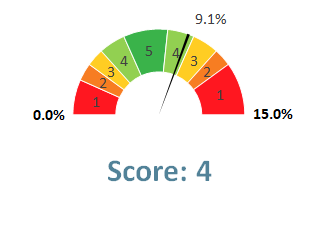

Profitability Growth

Lowe’s EBITDA has shown significant growth with a CAGR of 9.1% over the past decade. The strong performance highlights Lowe’s focus on improving operational performance and cost management.

While Lowe’s revenue decreased in 2024, its EBITDA strongly rebounded: 2024 EBITDA increased 10.3% from 2023. This suggests an effective cost control from the company in a difficult retail market. Lowe’s reduced its SG&A expenses by almost USD 5 billions compared to the prior year.

Find out more about the scaling system.

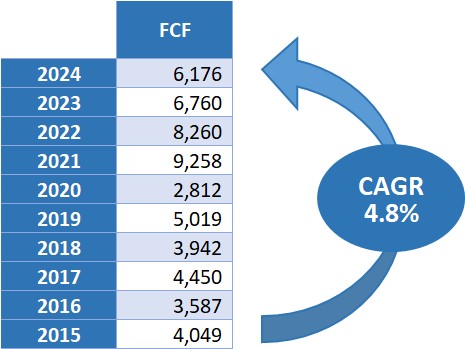

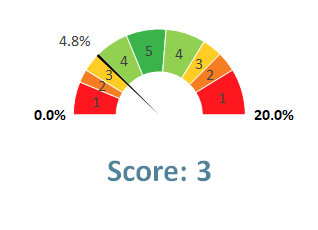

Free Cash Flow Growth

Lowe’s Free Cash Flow (FCF) has experienced a moderate growth, reaching a CAGR of 4.8% over the past decade. This growth supports Lowe’s ability to fund dividends, share buybacks, and strategic investments.

The FCF have decreased significantly after the highs of 2021 and 2022 but the company has kept a moderate long-term growth. It is important to note that its 2023 FCF included a USD 2.5bn one-off capital gain on the sale of their Canadian business. Thus, 2024 is showing a significant improvement in cash flows with a better inventory management.

Find out more about the scaling system.

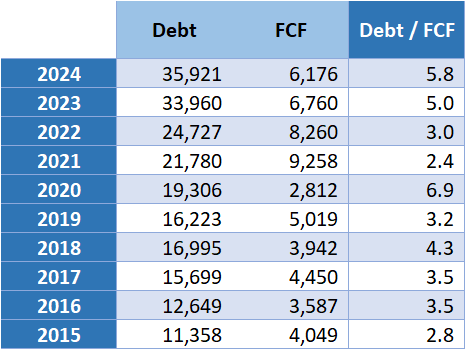

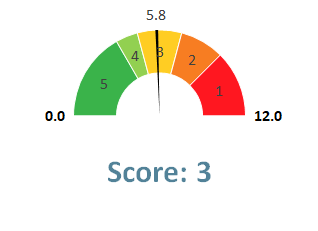

Debt Ratio

Lowe’s debt to FCF ratio keeps deteriorating and reached its highest point of 5.8 since the Covid-19 crisis. It suggests a significant reliance on debt which might require attention to ensure long-term financial health.

However, Lowe’s debt has increased at a slower pace than 2023 and 2022. The deterioration of its Debt to FCF ratio is mainly due to its difficulties to generate higher FCF.

Find out more about the scaling system.

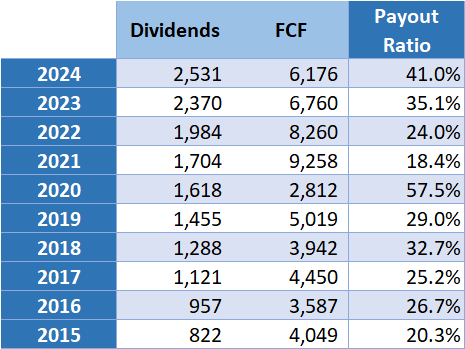

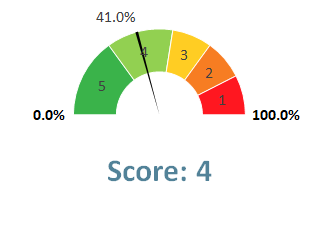

Payout Ratio

A payout ratio of 41.0% suggests that Lowe’s allocates a moderate portion of its earnings towards dividend payments. It leaves ample room for reinvestment and potential future dividend increases but has increased significantly compared to Lowe’s historical ratios.

41% is not alarming and ensures that the company can continue to reward shareholders while also investing in growth opportunities.

Find out more about the scaling system.

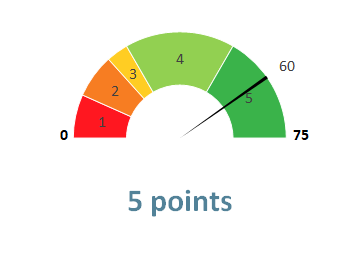

Consecutive Years of Dividend Growth

Lowe’s has increased its dividend payments during 60 consecutive years making the company a Dividend King. This impressive track record demonstrates Lowe’s commitment to returning value to shareholders and its confidence in the company’s long-term financial performance.

Find out more about the scaling system.

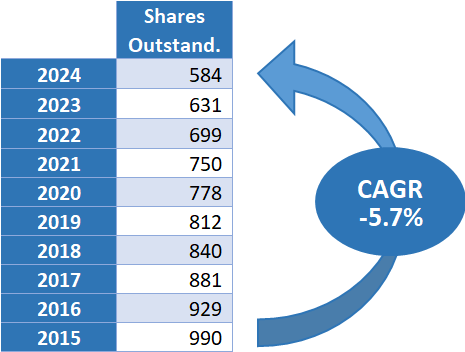

Shares Buy-Back

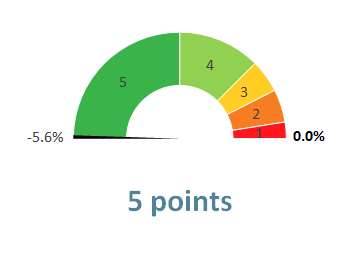

Lowe’s has engaged in significant share buybacks, reducing its outstanding shares by a CAGR of -5.7% over the past decade. This trend has not declined despite lower sales and FCF recorded in 2024 which reflects the management’s confidence in the company’s intrinsic value.

The reduction in outstanding shares through buybacks increases the value of remaining shares and is a great way to reward shareholders. Lowe’s is buying back outstanding shares at a strong pace.

Find out more about the scaling system.

Conclusion

Lowe’s stands out as a dividend stock with strong growth and stability. The recent challenges in 2024 highlight the company’s resilience and strategic efforts to navigate market dynamics and the company must improve its revenue growth and its debt situation to stay at the top of my dividend stock tier list.

What are your thoughts on Lowe’s performance and its ability to navigate market challenges? Share your insights in the comments, and let’s discuss!

Here is the final rank of LOW

in my tier list:

27 / 35 points