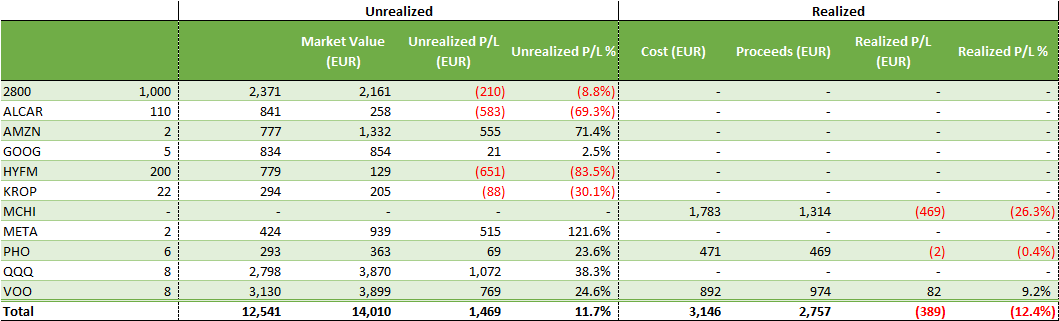

In Q2 2024, my long-term portfolio reached 14,010€ with an unrealized gain of +1,469€.

+16.5% vs. last quarter

+79.7% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 0.68 positions of QQQ @ USD 443.45 for a total of EUR 302 (fees included)

- Bought 0.63 positions of VOO @ EUR 477.57 for a total of EUR 302 (fees included)

- Bought 5 positions of GOOG @ USD 176.45 for a total of USD 895 (fees included)

Better late then never! As I anticipated in my previous articles, the market started to understand that rate cuts will not happen this summer which led to a small correction in stock prices during April. I took this opportunity to pause my DCA in April and resume it for the month on May and June. My DCA investment is still very limited as I prefer build up my dividends portfolio in this market situation. The FED will most likely start cutting its rates by the end of this year and a correction will most likely follow. I will keep investing USD 150 in both QQQ and VOO on a monthly basis for the time being.

You will notice that I also added a new position into my portfolio this quarter: GOOGLE. Google was the only GAFAM that was not insanely overvalued at the time. I’ll most likely build up this position overtime as long as the company is still growing its topline.

Q2 2024 was also the start of the luxury industry fall down. At the end of March, Kering Group released a profit warning which led to a 15% decrease on the news. Kering lost an additional 7% during the quarter while LVMH lost 13% of market cap in the same time. This situation is mainly due to the slow recovery happening in China. The country is still facing high unemployment rate and weaker demand than expected which directly impact luxury brands. This may become a buying opportunity for Q3 2024.

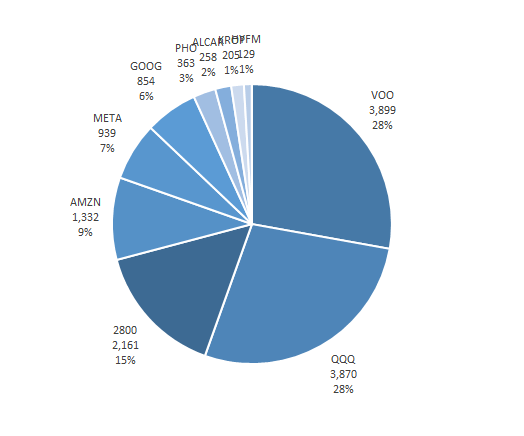

Allocation

As of Q2 2024, my strategy is still having a 75%/25% long-term portfolio.

- Market index ETFs represent 71% of my portfolio (QQQ, VOO and 2800).

- Thematic ETFs represent 4% of my portfolio (KROP and PHO).

- Individual companies represent 25% of my portfolio (AMZN, META, ALCAR HYFM).

My portfolio is well balanced at 75%/25%. I do not foresee major investment in individual companies in the current situation and I will continue with my DCA for the rest of 2024.

Performance

Top performer of the quarter:

- GOOG +17.2% in Q2 vs Q1

- QQQ +7.68% in Q2 vs Q1

- AMZN +6.79% in Q2 vs Q1

Q2 was quiet. Google was the only company with a double digit growth during the quarter. The market starts feeling that the AI boom pushed expectations (thus prices) too high. Companies invested heavily and raised sales expectations for 2024 but we start seeing a turn around. As the global consumption is slowing down, large tech companies start laying off employees and revised expectations downwards.

Google however is maybe one of the company that is not highly overvalued like the other tech companies, hence my purchase this quarter.

Worst performer of the quarter:

- HYFM -31.6% in Q2 vs. Q1

- ALCAR -43.10% in Q2 vs. Q1

Hydrofarm is once again in my worst performer list this quarter. My position is so small in this company that I prefer keeping it in my portfolio to force me to review its earnings reports every quarter and keep an eye on the industry.

ALCAR is still seeking for new cash injection to survive and does not exclude issuing new shares to raise more capital. This would significantly impact the stock price as it did the last time the company issue new shares to the public. I an still bullish on Carmat’s innovation though and will buy more shares if they dropped below EUR 2.