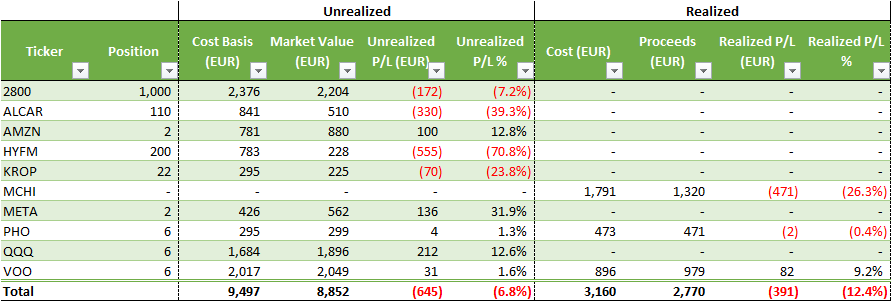

In Q3 2023, my long-term portfolio reached 8,852€ with an unrealized loss of -645€.

+13.6% vs. last quarter

+141.8% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 500 positions of 2800 @ HKD 18.92 for a total of EUR 1,097 (fees included)

- Bought 40 positions of ALCAR @ EUR 5.38 for a total of EUR 216.82 (fees included)

I stopped all my DCA investments into index ETF during Q3 2023 due to the global market sentiment. Inflation is still not under control in the USA and the market is unsure about what the FED is going to do with the interest rates going forward. I decided to pause my monthly contributions into my S&P500 and NASDAQ ETFs and wait for the expected market correction. I’m planning to resume all my ETF investments in Q4 2023.

Thus, my only contributions for this quarter have been 2800 and ALCAR.

2800 is an ETF covering the Chinese market which has been crushed in the last months. I consolidated my position to take advantage of lower price.

ALCAR is Carmat SA, a French company developing an artificial heart. The company has recently resumed the implantations of its artificial heart so I’m expecting the sales numbers to skyrocket in Q4 2023 and going forward. The company will still have issues with cashflows down the line but it should not be difficult for them to find new investments. The main question is: what form of cash injection will they accept? Dilutive? Non-dilutive? This is the main risk according to me. I’m still very bullish on this company but I need to control my exposure to this company.

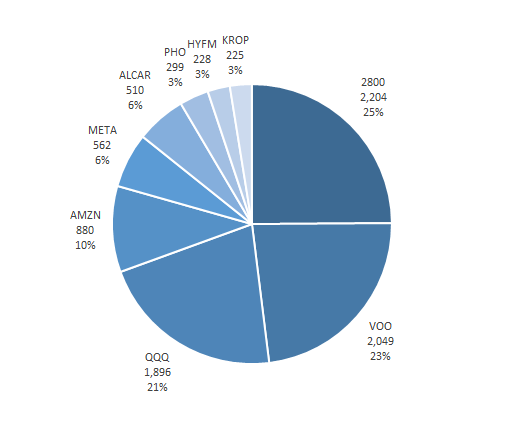

Allocation

As of Q3 2023, my strategy is still having a 75%/25% long-term portfolio.

- Market index ETFs represent 69% of my portfolio (QQQ, VOO and 2800).

- Thematic ETFs represent 6% of my portfolio (KROP and PHO).

- Individual companies represent 25% of my portfolio (AMZN, META, HYFM).

I would like to invest more into individual companies but I need to follow these investments with additional contributions towards ETFs.

Performance

Top performer of the quarter: