Automatic Data Processing (ADP) has established itself as a global leader in payroll services, delivering critical solutions to businesses since its inception. With a rich history, ADP has become synonymous with efficiency and reliability in workforce management.

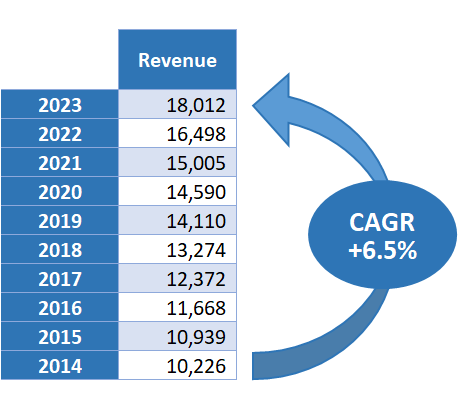

Revenue Growth

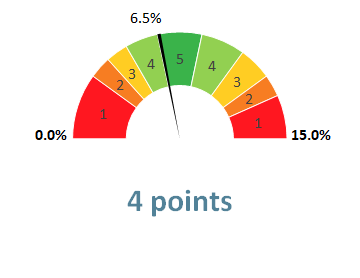

ADP has demonstrated steady revenue growth over the past decade with a Compound Annual Growth Rate (CAGR) of 6.5%. This CAGR aligns with our targeted high single-digit growth rate.

ADP’s moderate but steady revenue growth is a positive indicator of its ability to navigate market changes without relying on unsustainable spikes. The company managed to grow its revenue every single year for the past decade, even during the Covid crisis. This steadiness bodes well for income investors seeking reliability over time.

Find out more about the scaling system.

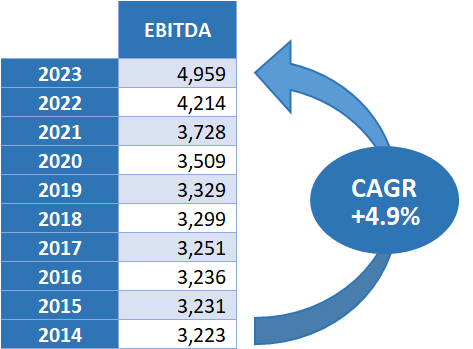

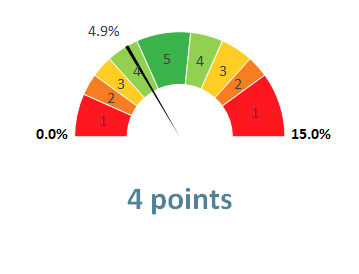

Profitability

ADP’s EBITDA has exhibited a steady increase, with a CAGR of 4.9%. EBITDA was slowly growing between 2014 and 2019 but saw a sharp growth over the past 4 years. It will be interesting to follow-up on this growth and see if ADP can sustains this growth.

A steady increase in EBITDA showcases ADP’s effective management of operating costs, contributing to the overall quality of earnings. This balance is crucial for sustaining dividend payments and supporting future growth.

Find out more about the scaling system.

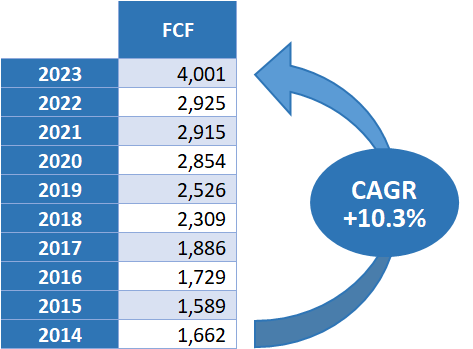

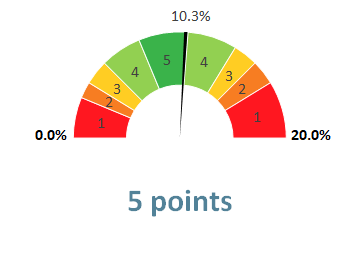

Free Cash Flow

Free Cash Flow (FCF) has experienced robust growth, reaching a CAGR of 10.3% and has been increasing every single year since 2015. However, please note that the CAGR was highly boosted by the exceptional 2023 FCF.

The robust growth in Free Cash Flow is a positive indicator of ADP’s ability to generate cash beyond its operational needs. This financial strength supports dividends and provides flexibility for strategic initiatives.

Find out more about the scaling system.

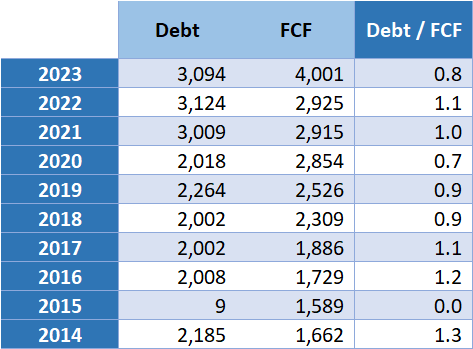

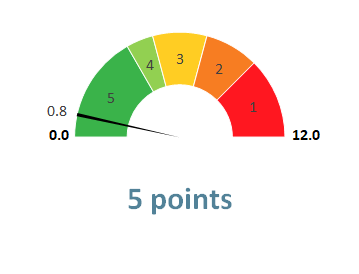

Debt Ratio

The debt to free cash flow ratio, currently standing at 0.8, has stayed very low for the past decade. This ratio is way below or target ratio of 5 and has stayed below this threshold for more than 10 years.

Even though ADP’s debt is increasing over time, the company generates robust cash flow mitigating concerns on ADP’s debt burden.

Find out more about the scaling system.

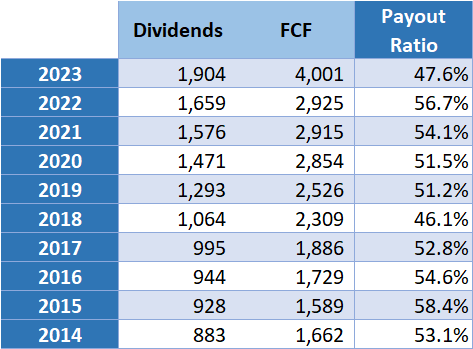

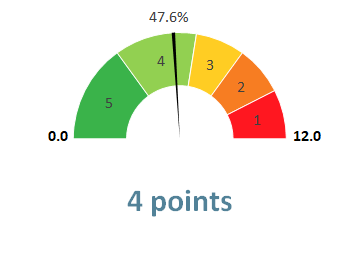

Payout Ratio

ADP’s 2023 payout ratio currently stands at an encouraging 47.6%, marking a notable improvement from its historical average of around 55%. This positive shift aligns with the exceptional Free Cash Flow (FCF) the company experienced in 2023. However, it is essential for ADP to consistently demonstrate its ability to maintain this lower ratio over time.

It’s important to highlight that this payout ratio is calculated based on ADP’s FCF rather than its earnings. Monitoring the evolution of this ratio is critical, serving as a key indicator of the sustainability of dividend payments.

At this level ADP is utilizing a moderate portion of its cash to pay dividends, leaving room for future investments, business expansion, and potential dividend increases.

Find out more about the scaling system.

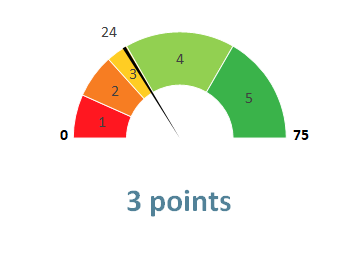

Consecutive Years of Dividend Growth

ADP boasts 24 consecutive years of dividend growth making it a great dividend aristocrat candidate for next year. This extended period of sustained dividends aligns with the company’s commitment to returning value to shareholders, reflecting a balance between growth and income.

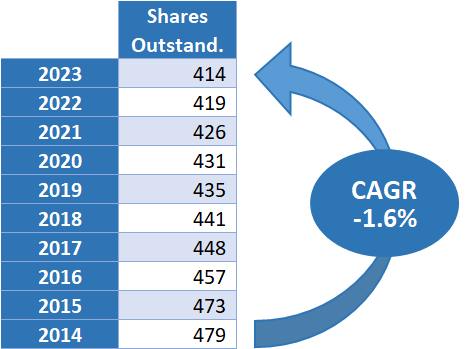

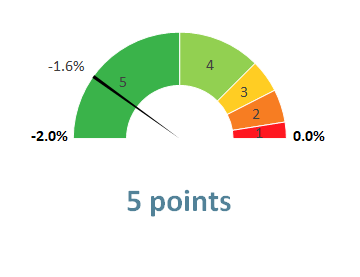

Shares Buy-Back

ADP’s engagement in share buybacks complements its growth strategy. ADP has been buying shares back consistently over the past decade decreasing its shares outstanding by 1.6% per year on average.

The diminishing trend in outstanding shares not only reflects a shareholder-friendly approach but also hints at management’s confidence in the company’s intrinsic value. The decreasing trend in outstanding shares suggests management’s confidence in the company’s fundamentals and a strategic approach to capital allocation.

Find out more about the scaling system.

Conclusion

ADP stands out as a dividend stock not just for its numbers but for its strategic approach to long-term growth with stability. The moderate yet consistent revenue growth, coupled with prudent financial management, positions ADP as a reliable choice for income investors seeking a balanced dividend stock.

What do you think? Would you add ADP into your portfolio? Please let me know in the comments section, and let’s discuss!

Here is the final rank of ADP

in my tier list:

30 / 35 points

1 thought on “Dividend Stock Analysis – ADP”