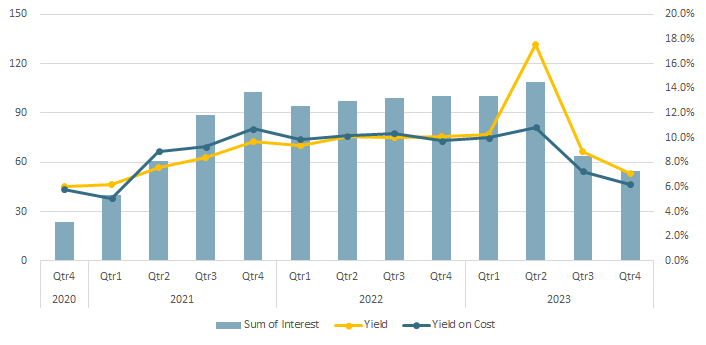

In Q4 2023, my crowdfunding portfolio decreased to 3,787€ and returned 55€ for a yield-on-cost of 6.2%. The overall decrease in performance of this portfolio in still due to the low activity with limited reinvestments. I realized that keeping cash in my crowdfunding accounts is damaging my return and I’m planning to solve this issue for Q1 2024.

Passive income: 55€

-9€ (i.e. -14.1%) vs. last quarter

-45€ (i.e. -45%) vs. the prior year period.

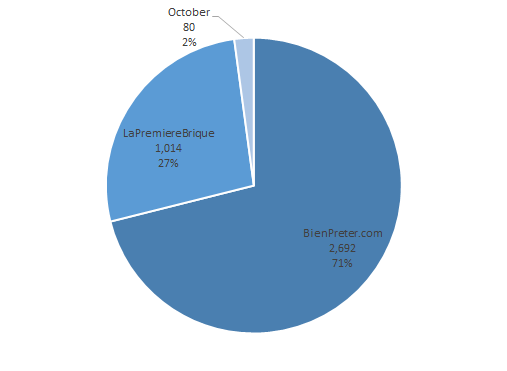

Allocation

I am almost out of my position on October website. I just have 3 remaining projects, all finishing in 2024. An update on all projects in default of payments will be detailed in the next section.

My position in LaPremiereBrique is still low compared to BienPreter. I still need to take my time since I don’t have much experience with this website but I am planning to increase my investment in LaPremiereBrique in the coming years.

As for my planning in the short-term, I crucially need to add another platform into my portfolio. It is not an easy task since most of the other websites require a much bigger investment (usually EUR 1,000). Feel free to let me know your favorite investment platforms in the comment section below.

Goals:

- Diversify my platform exposure with either Clubfunding or Baltis. (target 2024)

- Exit from October.

- Increase my position on LaPremiereBrique. (in progress)

Passive Income Evolution

In Q4 2023 my yield-on-cost decreased to 6.2% due to the small amount of reinvestment made during the quarter. The yield-on-cost represents my return on the cash invested and does not take into account whether I am allocating funds to new projects or not. My recent inactivity in crowdfunding investments led the yield-on-cost to keep decreasing.

The real performance of the projects selected is better represented by the yield (c.f. yellow line). This metric is based on the cash invested and disregards the cash left in my accounts. The yield keep decreasing as well because I am reallocating my funds from October, which pays interest on a monthly basis, to LaPremiereBrique, which pays interest when projects are completed. I’m expecting a few peaks in yield such as the one we saw in Q2 2023 starting 2025.

Major Updates

As of December 2023, I still have 4 projects in default for a total of 208€:

| Platform | Project | Provisions | Comments |

| October | FMPA | 115€ | Company placed in liquidation |

| October | Interlink Transport | 19€ | Certificate of uncollectible funds received |

| October | LOC MAT 43 | 7€ | Company placed in liquidation |

| October | Villari | 67€ | Company placed in liquidation |

Non of these investment will be paid back to me.