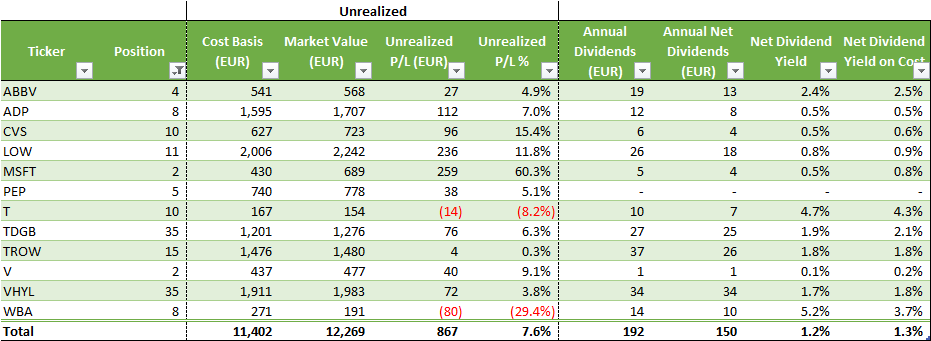

In Q4 2023, my dividends portfolio increased to 12,269€ and returned 61€ of net dividends for the quarter.

Passive income: 61€

+32.6% vs. last quarter

+455% vs. the prior year period

Portfolio Evolution

New contributions:

- Bought 4 shares of VHYL @ EUR 55.26 for a total of EUR 221.04 (fees included)

- Bought 15 shares of TDGB @ GBP 29.72 for a total of GBP 445.77 (fees included)

- Bought 2 shares of ADP @ USD 218.48 for a total of USD 436.95 (fees included)

- Bought 4 shares of CVS @ USD 71.60 for a total of USD 286.39 (fees included)

- Bought 3 shares of LOW @ USD 194.34 for a total of USD 583.03 (fees included)

- Bought 5 shares of PEP @ USD 161.57 for a total of USD 807.85 (fees included)

- Bought 5 shares of TROW @ USD 98.44 for a total of USD 492.20 (fees included)

- Bought 2 shares of V @ USD 238.59 for a total of USD 477.17 (fees included)

I took advantage of the market downturn in September 2024 to buy a lot of new positions in November. My new contribution in dividends stocks during this quarter has exceeded over EUR 3,000.

I mainly bought individual stocks and I feel like I should have invested more into ETFs (cf. “Allocation” section below).

I recently wrote a review of the ADP stock (here) to expose why I consider ADP a solid dividend stock. The company exhibits a steady revenue and FCF growth with a sustainable dividend payout.

TROW and V are also two solid choices. There are both companies drowning in cash with great future perspectives. Stay tuned for more information coming about these two companies here.

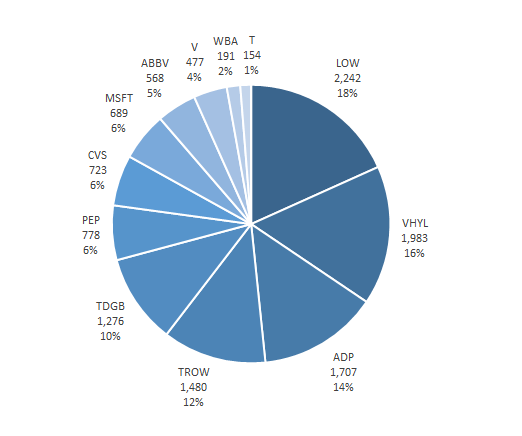

Allocation

Allocation target: 30% ETF and 70% individual stock.

- Dividends ETFs represent 26% of my portfolio (VHYL and TDGB).

- Individual companies represent 74% of my portfolio.

The proportion of my portfolio invested into dividends ETF decreased significantly due to the high appreciation of individual companies during the bull run of Q4 2023. This supports my objective of investing heavily in individual stocks but I will be exposed to capital loss in case of a market downturn. I would need to balance my allocation back to 30% / 70% in Q1 2024.

Performance

Top performer of the quarter:

- MSFT +16.86% in Q4 vs Q3

- CVS +13.30% in Q4 vs Q3

- T +14.38% in Q4 vs Q3

- LOW +8.17% in Q4 vs Q3

- V +12.57% in Q4 vs Q3

- WBA +16.46% in Q4 vs Q3

Microsoft appreciated sharply in Q4 2023 and is now at its all time highs. It’s definitely a great holding that I want to accumulate into my portfolio. I am just waiting for the right buying opportunity. As of Q4 2023, Microsoft represents 6% of my portfolio only.

Even though WBA grew faster than CVS in Q4 2023, I feel like CVS might be a better long term investment. I would need to dig further into the financials of both companies and publish my opinion in my Stock Analysis tier list.